Don’t judge each day by the harvest you reap but by the seeds you plant

- Robert Louis Stevenson

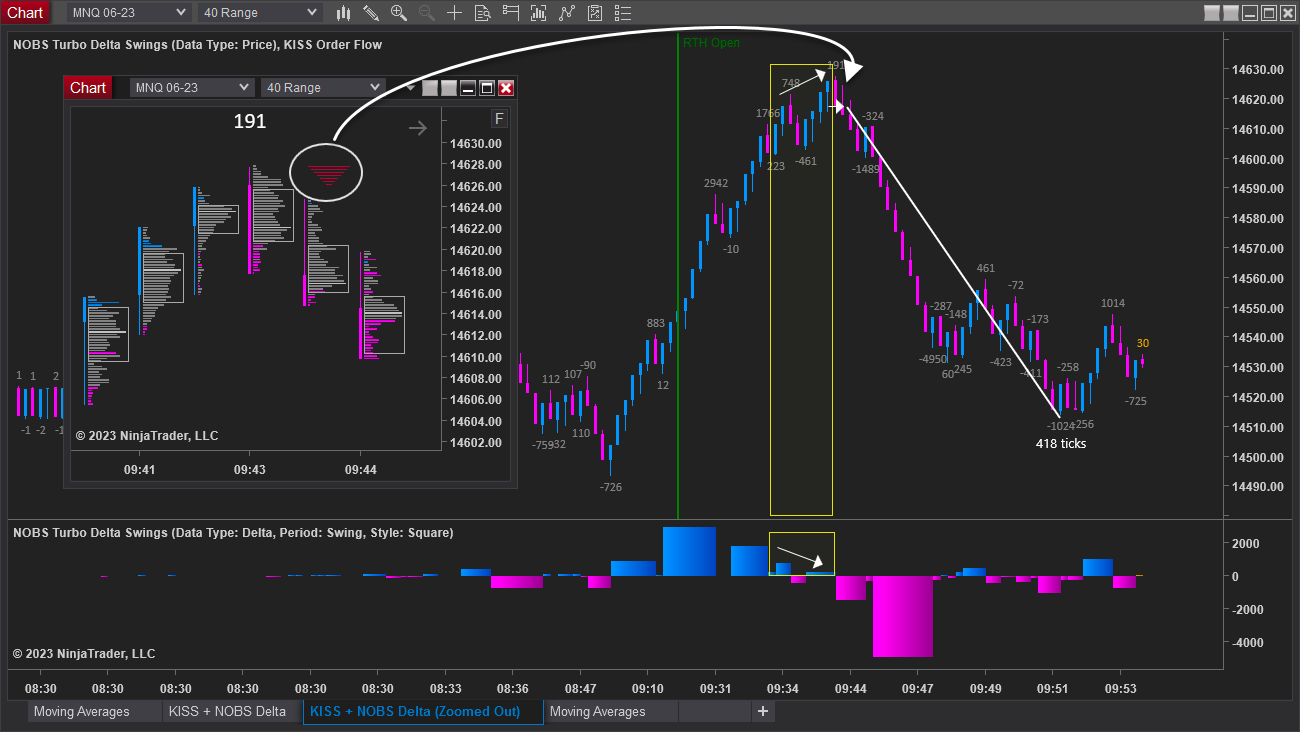

There are times when order flow setups work so beautifully, that I’m annoyed with myself for not looking at it sooner.

Then there are other days when everything lines up, even the stars, and despite this, it’s as useful as a marzipan dildo (any Malcolm Tucker fans in? Lol).

They’ve been loathed to admit it, but I have seen a few pro order flow traders concede that there are times when they cannot trust what the numbers are telling them.

Despite everything telling you to buy, the price keeps pounding down harder, and with more aggression, than your worst hangover. So why is this? Why are there times when we cannot rely on what the order flow is telling us?

F**k knows. I have just come to accept that when the market isn’t behaving normally, to not place too much credence on what the numbers are telling me. When this happens, I default to reading the bars.

When you’ve spent a bit of time watching price action on a short timeframe chart, you often can get a sense of which direction we may be heading in.

Also, when we reach key areas (e.g. yesterday’s low) sometimes you can almost feel the internal battle by watching how the bar forms. As always, he who has the deepest pockets wins!

When it doesn’t feel like the market is in the middle of a pissing contest by two gorillas on opposing sides, I usually have a good idea of which direction we may be heading in.

If the order flow isn’t giving me anything, I will then look to trade price action setups, or setups off my favourite moving averages:

My preference now is always to first look for order flow setups. I have seen many times how using order flow does give you a big edge over price action trading. Particularly when I’m looking to fade a move:

During the small percentage of time when the market is acting up, I’m now just mindful that the order flow might not be telling me the full story, and I trade the other setups instead.

As for when the market conditions are ‘normal’, your guess is as good as mine. All we can do is turn up each day, and trade what we see.

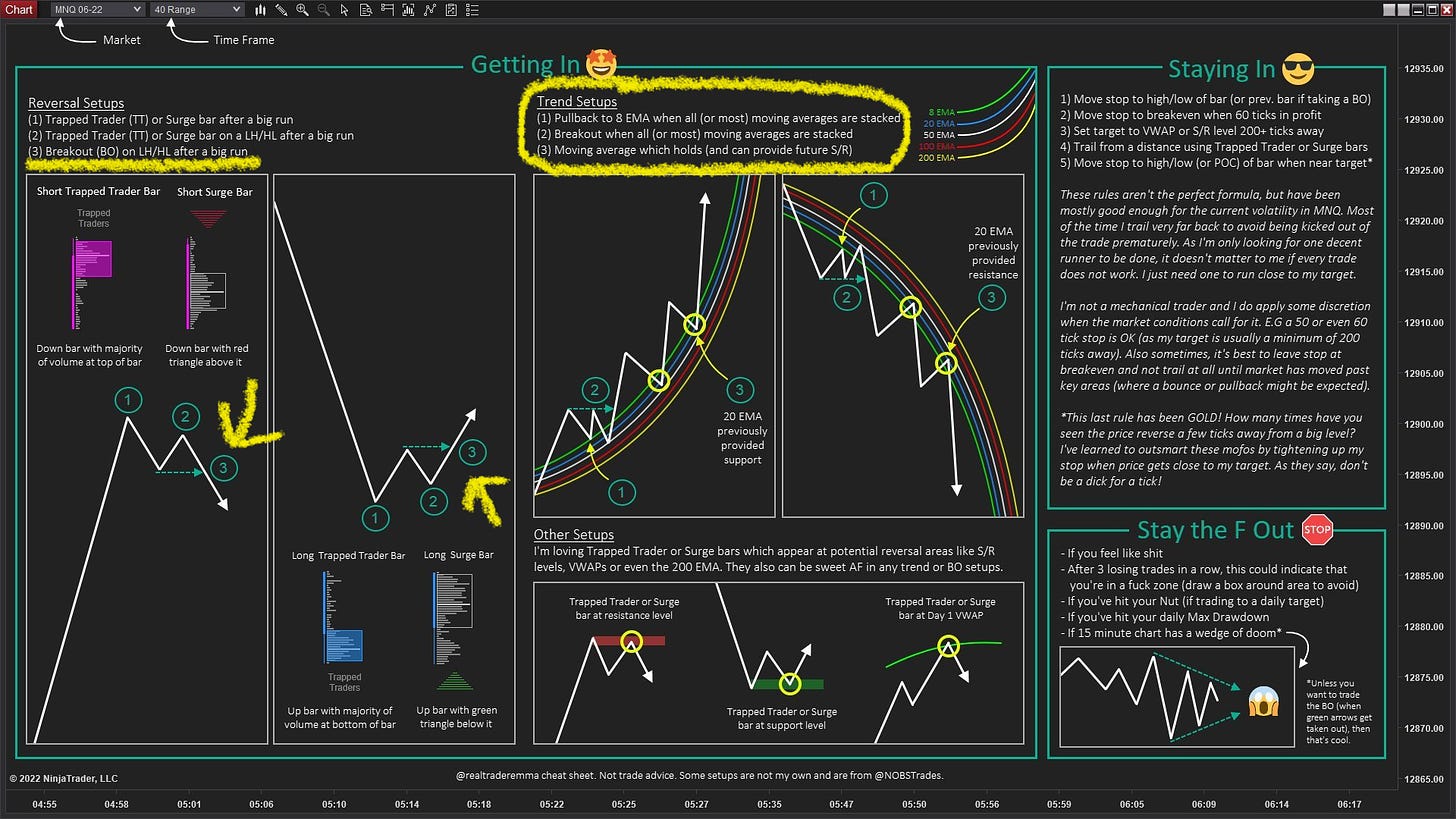

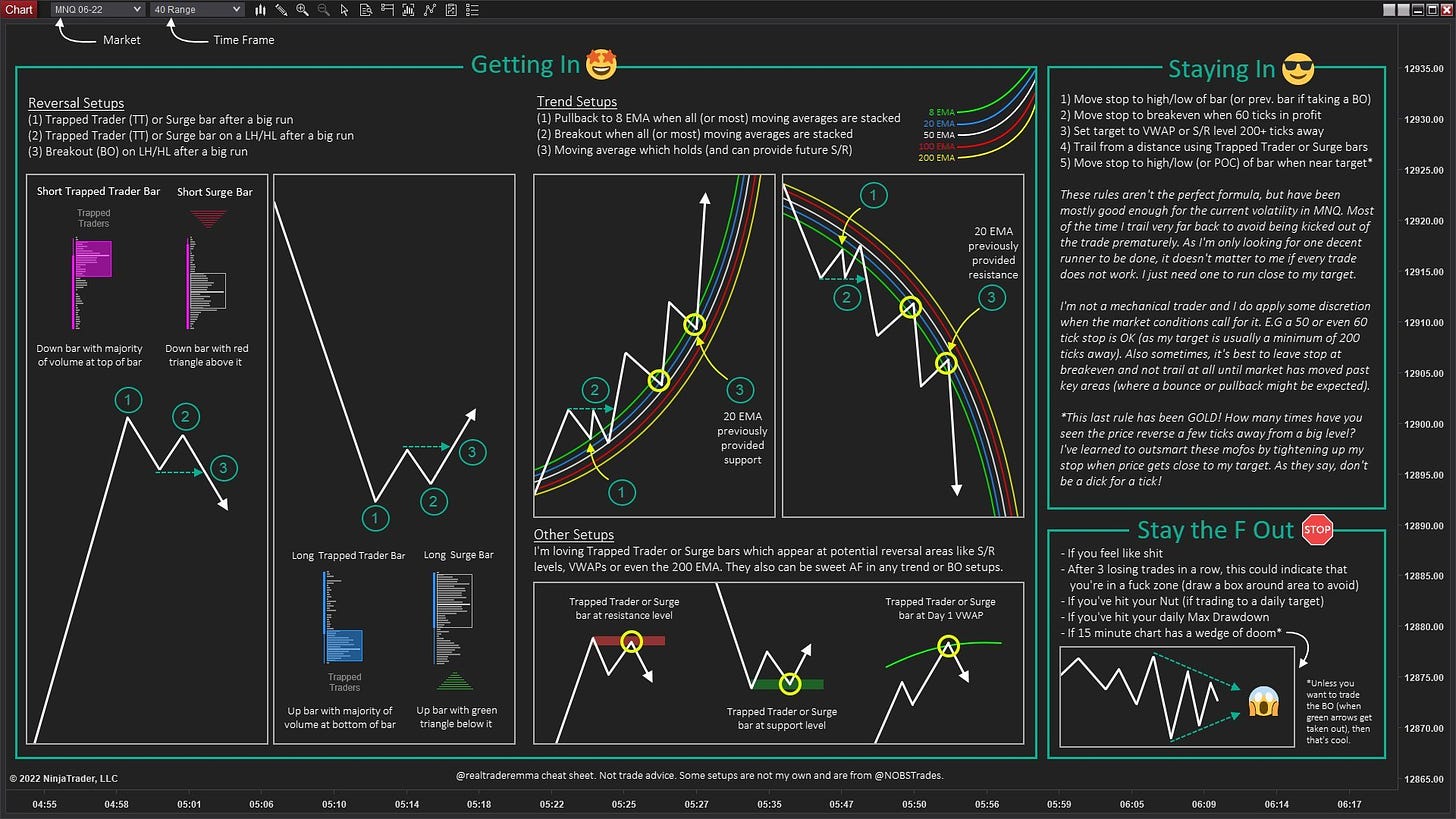

Cheatsheet

Here you go guys, my cheatsheet. There’s no space to cover the chart setup, please see details below:

40 Range Chart (my execution chart)

- 5 EMAs (8, 20, 50, 100 and 200)

- kissorderflow.com (Trapped Trader bars turned on: Max 6, Min 20)

15 min (my Big Picture chart)

- Day 1-5 VWAPS plus Weekly and Monthly VWAP

- Session high and low levels are enough for me, but you can go crazy

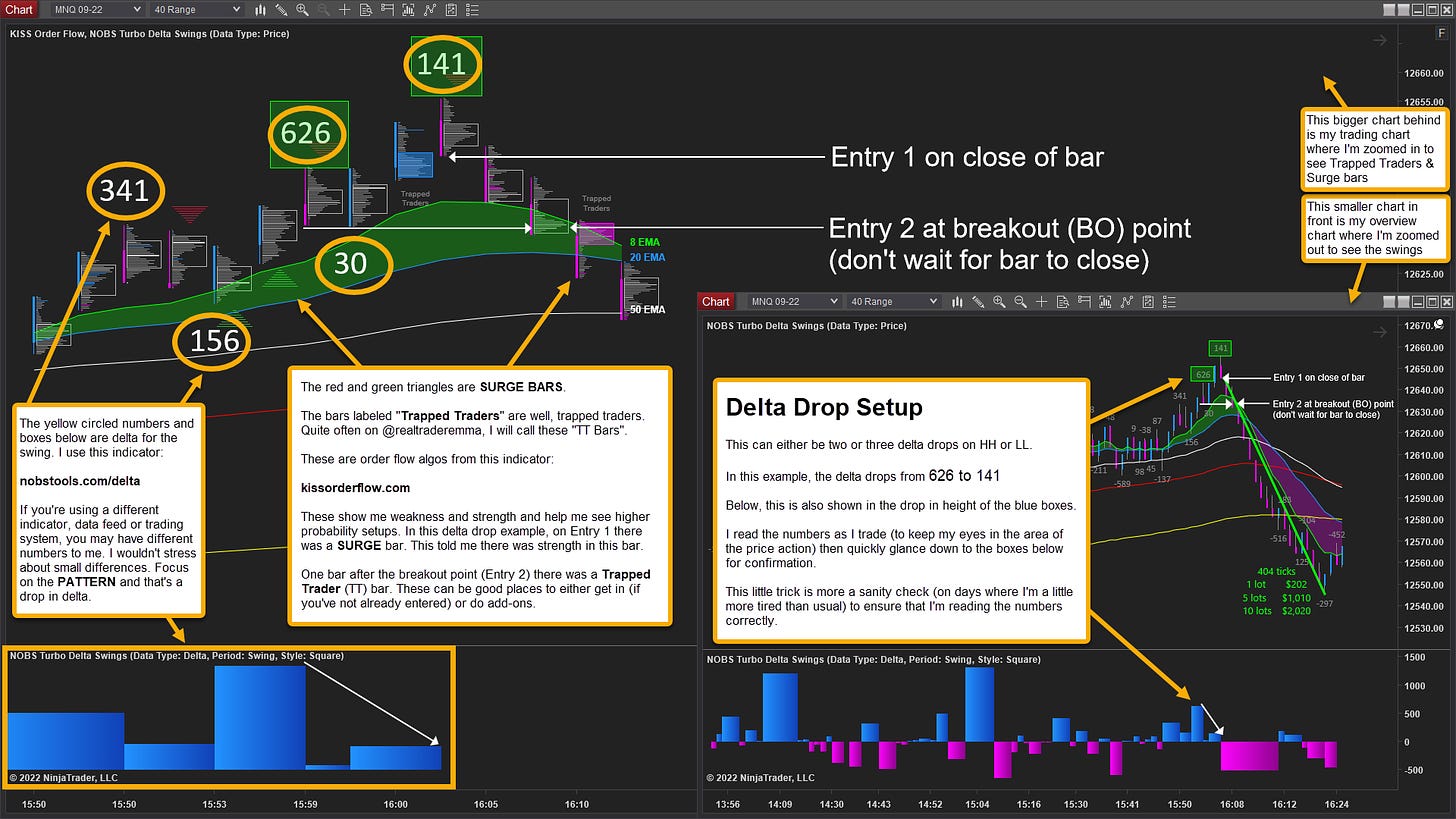

Delta Drop Setup

I’ll share what I’m using. I wouldn’t get too hung up on seeing the exact data. Small differences in delta largely do not matter. The same patterns will still be there.

nobstools.com/delta - For Swing Delta

kissorderflow.com - For Trapped Trader and Surge Bar algos

ninjatrader.com - Platform

I will never send you a message trying to sell you something, whether that’s mentoring, “holy grail” indicators and/or trading systems, or anything else like that. If you get a message from ‘me’ that’s asking for money, that WON’T BE ME. Please block and report these mofos.

This newsletter will always be 100% free and 100% spam free.

Your email will never be sold to any fucker.

Not trade advice! Please see about page for financial disclosure.

Been using built in order flow for ninja but looking at your charts I just bought the NOBS order flow. Thanks for the write up.

Hello Emma, I was wondering where you've been. I hope all is well!